Determine the Purpose of Your Cost Analysis

Next In: Nonprofit Cost Analysis Toolkit

-

Determine Purpose and Scope of Analysis

It is helpful to spend some time first thinking through the questions you are trying to answer with this analysis so that you can tailor subsequent steps to suit your purposes.

1. The primary reason for conducting cost analysis is generally to determine the true (full) costs of each of the programs under analysis (services and/or products). You can then utilize this knowledge to:

- Identify and prioritize cost-saving opportunities

- Fundraise from donors to cover the true costs of delivering the program

- Price the service or product (for paying beneficiaries) at a level that covers the true costs of providing it

- Report the true costs of a program when claiming government reimbursements

In all of these instances, knowing the true costs of a program allows you to determine the amount of revenue you need to generate from it (or the volume of funds you need to raise to support it) to ensure that the program is not a net consumer of resources for the organization.

2. When combined with an assessment of a program’s revenue and degree of mission-alignment, understanding the true costs of a program will also allow you to understand how each program contributes to your organization’s social mission and overall financial health. This information is instrumental to be able to:

- Allocate human and financial resources effectively

- Prioritize core programs that you must protect even in economically hard times

- Identify peripheral and financially unhealthy programs to eliminate

- Design smarter growth strategies

- Improve the financial health and mission alignment of the organization as a whole

This second set of decisions requires additional analysis, but a good understanding of the true costs of your programs is the indispensable first step.

Define Your Programs

Determine how your programmatic areas are to be delineated for this analysis—they will constitute the categories into which you will distribute your costs. It is important to note that, to calculate the true costs of a program, all organizational costs (including overhead) will need to be allocated across its programs. Overhead is essential for the proper functioning of an organization and, therefore, is an integral part of a program's costs.

For organizations running programs that are very distinct from one another, delineating programs should be an intuitive step. If you have several overlapping and inter-connected services, however, it may be helpful to spend some time mapping out whether they should be split from one another or grouped together into cohesive units.

A useful test to differentiate distinct programs is through comparing these elements for each program:

- What is the service offered?

- What resources are needed to offer that service?

- Whom is the service targeted at?

For programs that look similar in at least two out of these three dimensions, think carefully about whether they should be considered the same program in your analysis, even if they are usually categorized separately in fundraising.

The following program definition template can help guide you through this process:

Program Definition Template (Word)

This section has been devoted to programs, but its logic can also be applied to geographic sites or branches. A nonprofit leader who runs a single program but is administering it at multiple sites can conduct this same cost analysis to assess the financial demand of each site. We have not discussed "site definition" in detail in this toolkit as the process is generally straightforward for most nonprofits.

Determine Appropriate Programmatic Scope

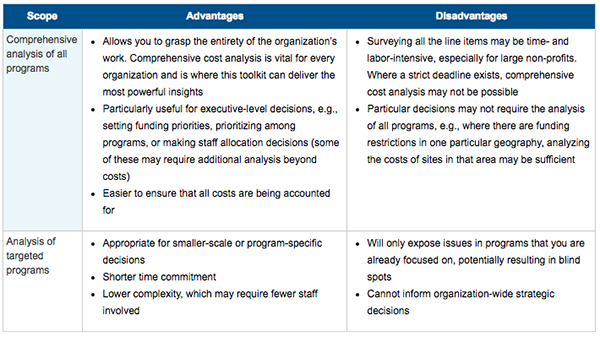

Is it realistic to conduct a comprehensive cost analysis of the entire organization, or should you only target the few programs in which you are particularly interested? This will depend on the situation and the type of decision you need to make. Some considerations include:

Identify Appropriate Time Period

As cost is driven in part by the length of time and specific period analyzed, it is important to identify a timeframe that makes sense for your purposes.

- If a disruptive event occurred recently but is unlikely to reoccur, it may be more accurate to use a longer time unit, such as the past two fiscal years, to smooth out the anomaly.

- If the nonprofit has launched new programs recently, the last 6 months may be more representative than a longer time period.

- It is also preferable to choose a time period for which accurate and representative revenue data exists, in case further analysis is needed in the future.