Impact-First Investing Services

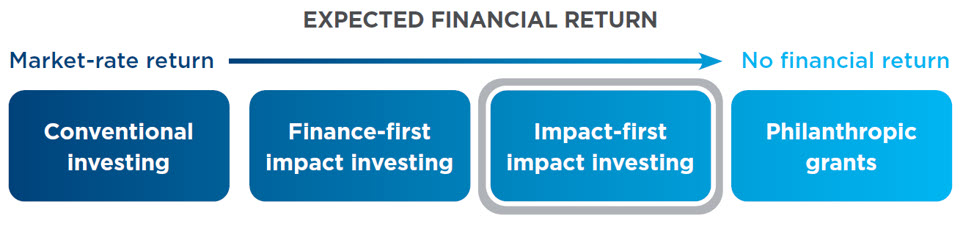

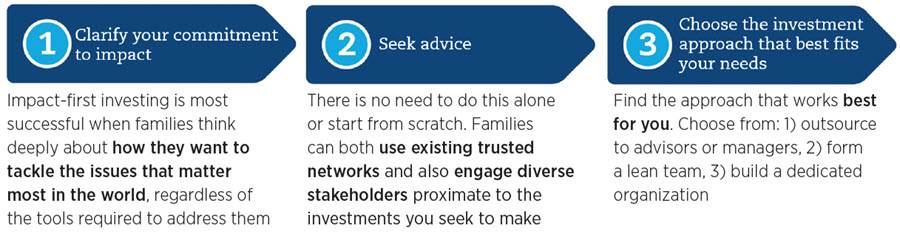

The Bridgespan Group supports impact-first investors who seek to be more catalytic or flexible as well as long-term in their pursuit of social and financial returns. Please visit Bridgespan Social Impact for more about how it works with leading global investors to successfully achieve both market-leading returns and social impact.

The Kresge Foundation works to expand opportunities in America’s cities through grantmaking and social investment. It seeks to influence the quality of life for urban populations today by investing in organizations that work in health, the environment, community development (particularly in Detroit, Memphis and New Orleans), arts and culture, education, and human services. Kresge uses funding methods beyond the traditional grant, including through Innovative Capital (debt) investments and guarantees. Bridgespan has supported Kresge on both their grantmaking and their social investing strategies as well as on the tactics of operationalizing and staffing these strategies.

The Kresge Foundation works to expand opportunities in America’s cities through grantmaking and social investment. It seeks to influence the quality of life for urban populations today by investing in organizations that work in health, the environment, community development (particularly in Detroit, Memphis and New Orleans), arts and culture, education, and human services. Kresge uses funding methods beyond the traditional grant, including through Innovative Capital (debt) investments and guarantees. Bridgespan has supported Kresge on both their grantmaking and their social investing strategies as well as on the tactics of operationalizing and staffing these strategies.

LIIF is a national CDFI leading the industry in funding healthy communities by providing innovative capital solutions. For more than 30 years, LIIF has invested more than $2.7 billion in high social value projects that lack access to traditional financial institutions, such as affordable housing, early child care and education, and the civic infrastructure needed for thriving communities. Bridgespan helped LIIF create an Impact-Risk-Profitability (IRP) framework to enable more intentional and balanced decision-making around impact, risk, and sustainability. The IRP framework includes both an upfront assessment of impact, risk, and profitability as well as an approach to evaluating the impact of LIIF’s loans to inform future lending. An assessment of a loan’s ability to drive racial equity is at the heart of the impact tool, informed by input from some 30 experts over the course of several months.

LIIF is a national CDFI leading the industry in funding healthy communities by providing innovative capital solutions. For more than 30 years, LIIF has invested more than $2.7 billion in high social value projects that lack access to traditional financial institutions, such as affordable housing, early child care and education, and the civic infrastructure needed for thriving communities. Bridgespan helped LIIF create an Impact-Risk-Profitability (IRP) framework to enable more intentional and balanced decision-making around impact, risk, and sustainability. The IRP framework includes both an upfront assessment of impact, risk, and profitability as well as an approach to evaluating the impact of LIIF’s loans to inform future lending. An assessment of a loan’s ability to drive racial equity is at the heart of the impact tool, informed by input from some 30 experts over the course of several months.

"Bridgespan’s team was incredibly dedicated in their work to steer LIIF toward a practical impact framework, and to help us visualize how to balance impact risk and profitability considerations to enable LIIF to carry out its strategy to lead with impact in our lending."

"Bridgespan’s team was incredibly dedicated in their work to steer LIIF toward a practical impact framework, and to help us visualize how to balance impact risk and profitability considerations to enable LIIF to carry out its strategy to lead with impact in our lending."

Low Income Investment Fund