For much of the past century, when donors wanted to give away their money, establishing a private foundation was the go-to structure. Indeed, many of America’s earliest philanthropists—Carnegie, Ford, Rockefeller—achieved impact through self-named foundations that continue to operate. Increasingly, however, donors are turning to additional giving structures, with many philanthropists employing multiple structures to advance their giving. The right mix of philanthropic legal structures is different for everyone, so it’s no surprise that one of the most common questions philanthropists have when ramping up their giving is “what structure or combination of structures should I use?” The question is at its core a financial and technical one, but there are important strategic considerations to keep in mind. This guide is not intended to replace more specific tax, estate, or legal counsel, but instead offers a walk through a few of the options and some considerations when making this decision.

How to make your decision

So, how to go about choosing from among the growing number of options? Like so many choices in philanthropy, the decision of which structure to pursue (if any) is an intensely personal one. Your decision should be the right choice for you at this moment in time, and it might be subject to change. You can revisit your giving structure annually to determine whether your vehicle is achieving the goals you’ve identified. Given this, it may be better to start with unstructured giving and ramp up to more structure over time. It can be tedious to “undo” a giving structure; the opportunity cost and expense of a foundation, for example, is much more significant than a donor advised fund.

Also, consider that the right solution might be to operate through multiple structures. None of these structures are mutually exclusive. For example, you might wish to develop deep expertise and presence in one issue area through a foundation, while conducting discretionary giving informally, simply by writing checks. In this way, you enjoy the many advantages of a foundation in the issue that matters most to you, while limiting the administrative burden of your other philanthropy.

In addition, you may not want to choose a giving structure without consulting tax and/or legal professionals

Types of philanthropic giving structures

Above and beyond writing checks, there exists a range of more formal giving structures. Based on differences in financial features, strategic control and a number of other factors, these giving structures can be thought of in two groups: non-foundation structures and private foundations.

Non-foundation structures

- Donor advised funds are charitable funds managed by a third-party organization. Commonly, these sponsoring organizations include mutual funds, investment advisors, or community foundations. An individual or family establishes a fund within the sponsoring organization and can then direct the sponsor to disburse the funds as they desire. Though the sponsoring organization ultimately controls where the money is distributed, it typically will honor the advice of the donor.

- Giving circles are vehicles that allow you to pool your charitable investments with other donors for the purpose of investing in an anchor of shared interest. By aggregating your money with other donors, it’s possible to achieve greater leverage in that field.

- Charitable remainder trusts are funds that allow the donor to convert assets into a stream of annuities for a period of time. After that time, whatever is remaining in the trust is donated to an identified charitable cause.

- Finally, some donors choose to establish an operating public charity with their investment, which is a 501(c)(3) nonprofit that receives contributions from many sources, like the public or government.

Private foundation

A private foundation is a 501(c)(3) nonprofit organized to make grants with a charitable purpose. Unlike charities, which get their money from public sources, a private foundation is organized with money from an individual, family, or corporation. In the United States, private foundations must pay out 5% of their assets annually or pay an excise tax. For more on private foundations, visit GrantSpace.

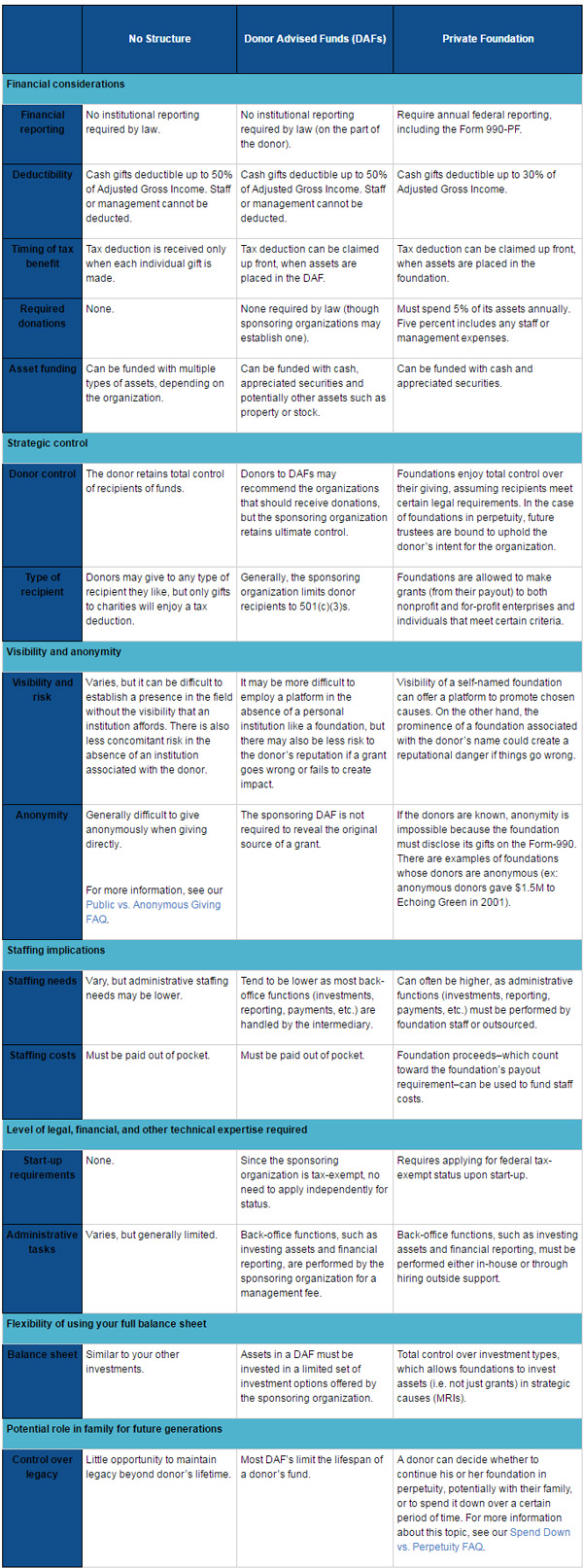

The table below describes some of the key differences between giving with no structure, giving through one type of non-foundation structure (donor advised funds), and giving through a private foundation. Donor advised funds are highlighted below as an example of non-foundation structures because they outnumber other non-foundation giving structures and are the fastest-growing non-foundation giving vehicle for living donors.

Note: Information provided in this table is for reference only and may vary depending on the specifics of the vehicle you choose. Laws and guidelines may change over time. You should consult an attorney or financial planning professional to verify how it applies to your chosen structure.

Sources Used for This Article

- Ron Barnett, Giving Circles Mix Fun, Fundraising, USA Today (2008)

- Council on Foundations, Definition of a Donor Advised Fund (2006)

- Foundation Center, Foundation Directory Online, Echoing Green Form 990-PF, 2002 (accessed March 2012)

- Foundation Center, Grant Space, What Is a Foundation? (accessed December 2011)

- Investopedia, Definition of Charitable Remainder Trust (accessed 2011)

- IRS, Tax Information for Private Foundations and other giving structures (accessed December 2011)

- Ruth Masterson, Association of Small Foundations, The Best of Both Worlds: Using Private Foundations and Donor Advised Funds (2010)

- The National Philanthropy Trust, Donor-Advised Funds vs. Private Foundations (accessed December 2011)

- Paul Sullivan, Weighing the Best Vehicles For Philanthropic Giving, New York Times (2011)